Az Ügyfélszolgálati üzenetek kézbesítésének konfigurálása

Az Üzenetközpont preferenciák konfigurálásához:

1. Jelentkezzen be az Ügyfélportálra

2. Kattintson a Felhasználó menüre (jobb felső sarokban található Felhasználó ikon), majd a Biztonságos Üzenetközpont lehetőségre.

3. Kattintson a Preferenciák (fogaskerék) ikonra a Létrehozás gomb mellett.

4. Megjelenik az Üzenet Preferenciák ablak

5. A legördülő menükből válassza ki az üzenetek Elsődleges és Másodlagos Preferált Nyelvét

6. Válassza ki a preferált kézbesítési opciókat az Üzenet biztonságos kézbesítése pontban.

7. A változások mentéséhez kattintson a MENTÉS gombra.

Felhívjuk a figyelmét, hogy biztonsági okokból nem lehetséges a teljes üzenet elküldése e-mail vagy SMS/szöveges üzenet formájában. E-mail vagy SMS/szöveges üzenet útján csak a közlemény összefoglalóját tudjuk elküldeni.

Az Üzenetközpont Preferenciákkal kapcsolatos további információkért kérjük, olvassa el az Ügyfélportál Felhasználói útmutatóját.

How to Access Your Reports Using FTP on MacOS

This tutorial assumes you received reports via email or via FTP that were encrypted with the public key you sent to IBKR. If you need guidance to set up the encrypted statement delivery, please refer to this article, which is a prerequisite to the instructions below.

There are multiple methods to access the IBKR FTP server. FTP clients such as Filezilla can be used or you could as well use Finder. In this article we explain how to realize the connection to the IBKR FTP server using Finder.

Important Note: You will not be able to connect using your browser.

Once you are connected to the IBKR FTP Server, you will have both read and write access to your folder. The retention policy for the files is 100 days - IBKR will automatically purge files after that.

To access your reports using macOS Finder:

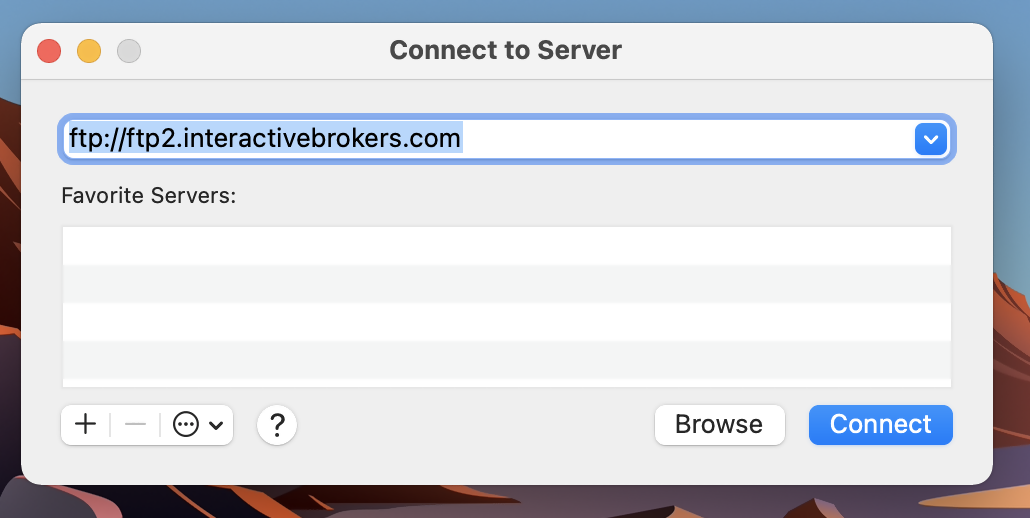

1. Open the Finder app. From the top menu Go, select Connect to Server... Alternatively, you can press Command + K on the keyboard while the Finder app is open.

2. Type the FTP address ftp://ftp2.interactivebrokers.com in to the Connect to Server field and click Connect.

3. A login dialog window will then appear. Select 'Registered User' for the Connect As field. Enter the FTP username and password IBKR provided you with in to the corresponding fields. Then press Connect.

.png)

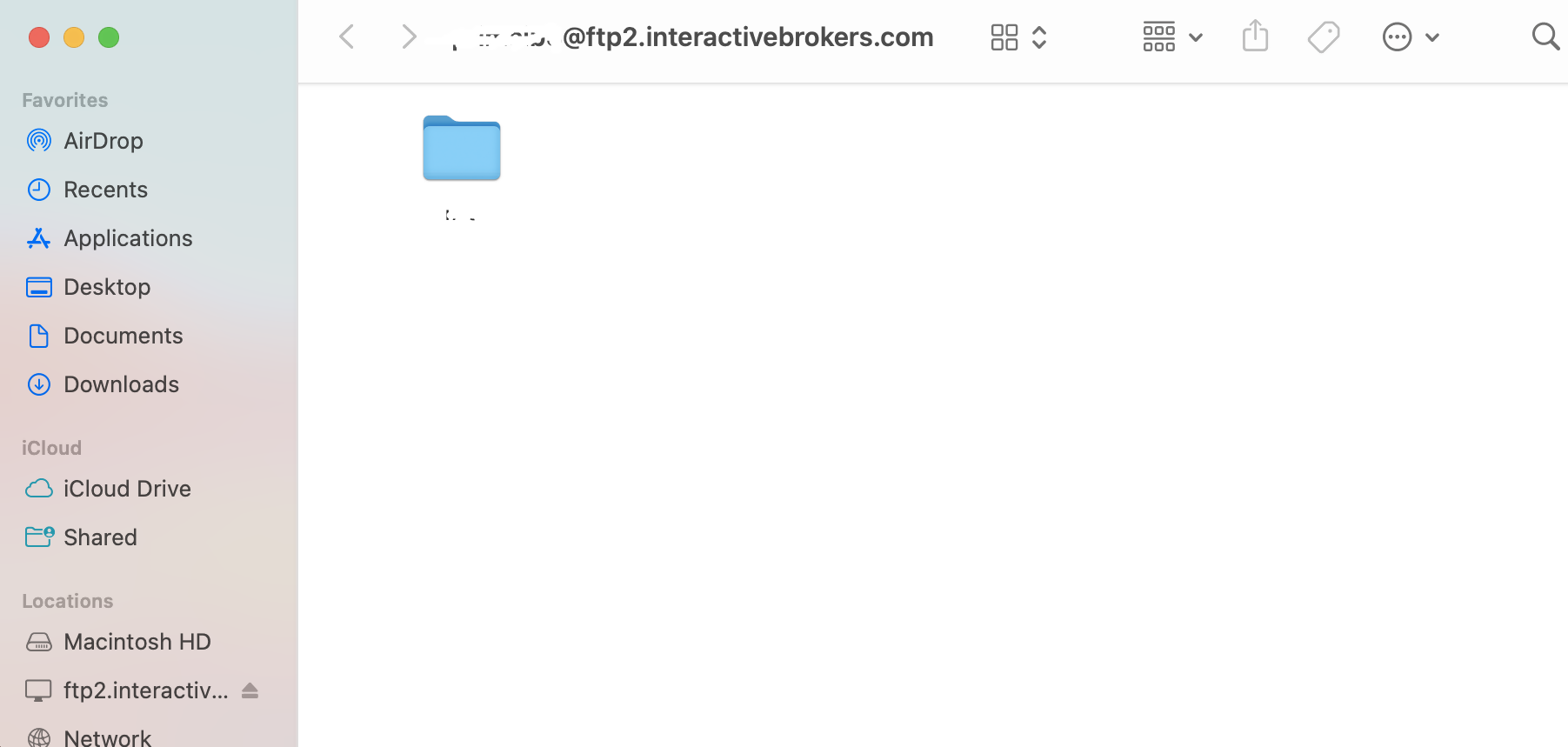

4. A Finder window will open and you will now have direct access to your FTP folder. Documents and files present there can now be decrypted using your PGP key, as explained in IBKB4210.

Common issues and solutions

Ensure the correct login details are being used to connect to the FTP server. The username and password you are entering should match the ones you have received from the Reporting Integration Team.

-

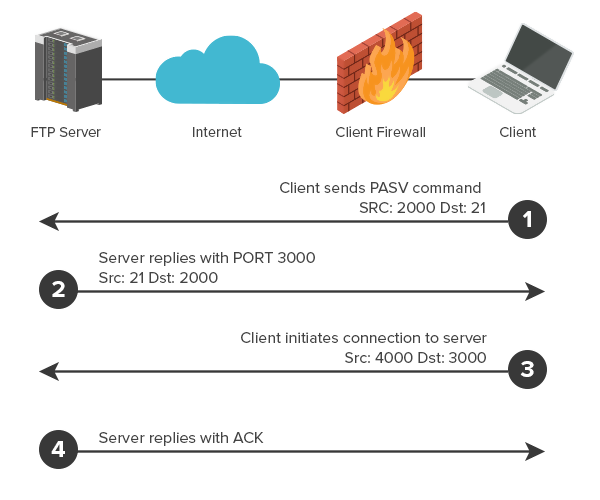

Enable the Passive (PASV) mode for FTP connections. Click on the Apple icon on the top left of your Desktop and choose System Preferences. Launch Network. Select your active network connection, then click on the button Advanced and select the Proxies tab. Activate the option Use Passive FTP mode (PASV). The passive mode is more firewall friendly then the active one, since all the connections are initiated from the Client side. If you are using a specific FTP Client, check its connection settings or advanced settings in order to find and enable the Passive (PASV) mode switch.

-

In case you have an antivirus or a security software installed on your machine, make sure it is not blocking the FTP connection attempt. Normally, security software allow to set up exceptions for specific connections in order to whitelist them.

-

Should the above steps be unable to resolve the issue, ask your network administrator/s to confirm that your firewall allows traffic from/to ftp2.interactivebrokers.com. Note: Your network administrator should consider that every time your FTP Client attempts connecting to our FTP server with Passive mode, it establishes two connections: a command channel (outbound, from random TCP port above 1024 to TCP port 21) and a data channel (outbound, from a random TCP port above 1024 to the TCP port above 1024 which was negotiated through the command channel). Both connections are initiated by the Client side. In the picture below, you can find an example of this connections schema. Please notice that the ports 2000, 3000, 4000 are examples of randomly selected ports and may very well not correspond to the ones used within your specific FTP connection attempt.

KB3968 - Generate a key pair using GPG for Windows

KB4205 - Generate a key pair using GPG Suite on macOS

KB4108 - Decrypt your Reports using GPG for Windows

KB4210 - Decrypting Reports using your PGP Key pair on macOS

KB4407 - Generate RSA Key Pair on Windows

KB4409 - How to set up sFTP for using Certificate Authentication on Windows

KB4410 - How to set up sFTP for using Certificate Authentication on macOS

KB4411 - How to backup your public/private Key pair

KB4323 - How to transfer your public/private key pair from one computer to another

Hogyan lehet ".har" fájlt létrehozni?

A weboldallal kapcsolatos, összetettebb problémák elhárítása során esetenként szükséges, hogy az Ügyfélszolgálati csapatunk további információkat szerezzen be az Ön böngészőjének kommunikációjáról. Előfordulhat, hogy megkérjük Önt, hogy rögzítsen és adjon át a részünkre egy .har fájlt. Ez a fájl további információkat tartalmaz az Ön böngészője által küldött és fogadott hálózati kérésekről. A böngészője a HTTP/HTTPS kérések és válaszok tartalmának, időrendjének és állapotának rögzítésével képes ilyen fájlt létrehozni a probléma felmerülése során.

Ebben a cikkben összefoglaljuk a .har fájlok lérehozásának menetét. Kérjük, hogy az alábbi listából válassza ki az Ön által használt böngészőt:

HAR fájl létrehozása Google Chrome-ban:

1. Nyissa meg a Google Chrome-ot, és lépjen arra az oldalra, ahol a probléma jelentkezik.

2. Nyomja le a CRTL +SHIFT + I kombinációt a billentyűzeten. Alternatív megoldásként kattintson a Chrome menü ikonjára (három függőleges pont a böngészőablak jobb felső sarkában), és válassza ki a További eszközök > Fejlesztői eszközök menüpontot

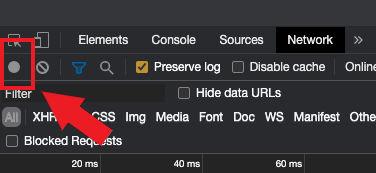

3. A Fejlesztői eszközök dokkolt panelként nyílnak meg a Chrome ablak oldalán vagy alján. Válassza ki a Hálózat fület (1. ábra)

1. ábra

.png)

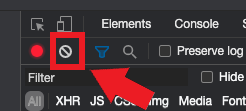

4. Keresse meg a Fejlesztői Eszközök eszköztár bal felső sarkában található kerek Felvétel gombot, és győződjön meg róla, hogy piros. Ha szürke, kattintson rá egyszer és kezdje el a felvétel rögzítését, vagy nyomja le a CTRL+E (2. ábra)

billentyűkombinációt.

2. ábra

5. Aktiválja a Napló megőrzése (3. ábra)

jelölőnégyzetet.

3. ábra

.png)

6. Kattintson a Törlés gombra az esetleges korábbi naplók törléséhez. A Törlés gomb rendelkezik egy stop ikonnal, és a Felvétel gombtól (4. ábra) jobbra helyzekedik el

4. ábra

7. Reprodukálja a tapasztalt problémát, miközben zajlik a hálózati kérések rögzítése.

8. Ha sikerült reprodukálni a problémát, kattintson a jobb egérgombbal a rögzített hálózati kérések listája felett bárhol, válassza ki az Összes mentése HAR fájként tartalommal opciót, és mentse el a fájlt az Ön által választott helyre a számítógépén (pl. az Asztalra).

9. Az IBKR Ügyfélportálról lépjen az Üzenetközpontra, és hozzon létre egy új webes hibajegyet (vagy, indokolt esetben, használjon egy meglévőt)

10. A webes hibajegyhez csatolja a korábban létrehozott .har fájlt. Ha az IBKR Ügyfélszolgálattól korábban kapott egy hivatkozási számot vagy kapcsolattartó nevet, kérjük, ezt az információt is írja be a hibajegy szövegtörzsébe.

11. Nyújtsa be a webes hibajegyet.

HAR fájl létrehozása Firefoxban:

1. Nyissa meg a Firefoxot, és lépjen arra az oldalra, ahol a probléma jelentkezik.

2. Nyomja le az F12 gombot a billentyűzeten. Alternatív megoldásként kattintson a Firefox menü ikonjára (három párhuzamos vízszintes vonal a böngészőablak jobb felső sarkában), majd válassza ki a Webfejlesztő > Hálózat

opciót

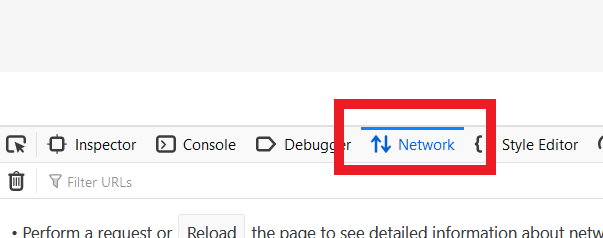

3. A Fejlesztői hálózati eszközök dokkolt panelként nyílnak meg a Firefox ablak oldalán vagy alján. Válassza ki a Hálózat fület (5. ábra)

5. ábra

4. Aktiválja a Naplók megőrzése (6. ábra)

jelölőnégyzetet.

6. ábra

.png)

5. Reprodukálja a tapasztalt problémát. A hálózati kérések rögzítése automatikusan elindul.

6. Ha sikerült reprodukálni a problémát, kattintson a jobb egérgombbal a rögzített kérések listája felett bárhol, ÉS válassza ki az Összes mentése HAR-ként opciót.

7. Mentse el a fájlt az Ön által választott helyre a számítógépén (pl. Asztal).

8. Az IBKR Ügyfélportálról lépjen az Üzenetközpontra, és hozzon létre egy webes hibajegyet (vagy, indokolt esetben, használjon egy meglévőt).

9. A webes hibajegyhez csatolja a korábban létrehozott .har fájlt. Ha az IBKR Ügyfélszolgálattól korábban kapott egy hivatkozási számot vagy kapcsolattartó nevet, kérjük, ezt az információt is írja be a hibajegy szövegtörzsébe.

10. Nyújtsa be a webes hibajegyet.

HAR fájl létrehozása Microsoft Edge-ben:

1. Nyissa meg az Edge-et, és lépjen arra az oldalra, ahol a probléma jelentkezik.

2. Nyomja le az F12 gombot a billentyűzeten. Alternatív megoldásként kattintson az Edge menü ikonra (három vízszintes pont a böngészőablak jobb felső sarkában), majd válassza ki a További eszközök > Fejlesztői eszközök

menüpontot.

3. Kattintson a Hálózat fülre (10. ábra).

10. ábra

.png)

4. Reprodukálja a korábban tapasztalt problémát, miközben zajlik a hálózati kérések rögzítése.

5. Ha végzett, kattintson a floppy lemez ikonra (Exportálás HAR-ként) vagy nyomja le a CTRL+S (11. ábra)

billentyűkombinációt.

11. ábra

.png)

6. Válasszon egy fájlnevet és egy helyet a számítógépén (pl. az Asztalon). Majd kattintson a Mentés gombra

7. Az IBKR Ügyfélportálról lépjen az „Üzenetközpontra”, és hozzon létre egy webes hibajegyet (vagy, indokolt esetben, használjon egy meglévőt).

8. A webes hibajegyhez csatolja a korábban létrehozott .har fájlt. Ha az IBKR Ügyfélszolgálattól korábban kapott egy hivatkozási számot vagy kapcsolattartó nevet, kérjük, ezt az információt is írja be a hibajegy szövegtörzsébe.

9. Nyújtsa be a webes hibajegyet.

HAR fájl létrehozása Safariban:

Megjegyzés: a HAR fájl létrehozása előtt győződjön meg róla, hogy látja a Fejlesztés menüt a Safariban. Ha nem látja ezt a menüt, kattintson a Safari menüre, válassza a Preferenciákat, lépjen a Haladó fülre, és aktiválja a Fejlesztés menü mutatása a menü fülön jelölőnégyzetet.

1. Nyissa meg a Fejlesztés menüt és válassza ki a Webellenőr mutatása opciót, vagy nyomja le a CMD+ALT+I billentyűkombinációt.

2. Kattintson a Hálózat fülre (12. ábra).

12. ábra

3. Aktiválja a Napló megőrzése (13. ábra)

jelölőnégyzetet.

13. ábra

.png)

4. Kattintson az Export ikonra (vagy nyomja le a CMD+S billentyűkombinációt), adja meg az Ön által választott fáljnevet és egy helyet a számítógépén (pl. az Asztalon), és mentse el a .har fájlt.

5. Az IBKR Ügyfélportálról lépjen az „Üzenetközpontra”, és hozzon létre egy webes hibajegyet (vagy, indokolt esetben, használjon egy meglévőt).

6. A webes hibajegyhez csatolja a korábban létrehozott webarchívum fájlt. Ha az IBKR Ügyfélszolgálattól korábban kapott egy hivatkozási számot vagy kapcsolattartó nevet, kérjük, ezt az információt is írja be a hibajegy szövegtörzsébe.

7. Nyújtsa be a webes hibajegyet.

Overview of IBKR's Recurring Investment Feature

IBKR offers an automatic trading feature whereby account holders may set up a 'recurring investment' instruction with the cash amount, asset to invest into and the schedule when to invest (e.g. buy 500 USD of IBKR on the 2nd day of the month). Outlined below are a series of FAQs which describe the program and its operation.

1. How can I participate in the program?

Requests to participate are initiated online via Client Portal. Select the Trade menu option followed by Recurring Investments.

2. What accounts are eligible to use IBKR's recurring investment feature?

Recurring investment is available to any client that has fractional share trading enabled and is under IBLLC, IBUK, IBAU, IBCAN, IBCE, IBIE, IBHK, or IBSG.

3. Which securities are eligible for recurring investment?

The recurring investment feature is available for US, Canadian and European stocks/ETFs. Only stocks/ETFs which are tradable in fractions are eligible.

4. When does the investment occur?

The client is able to choose a date and select a schedule on which to invest (e.g. weekly, monthly, quarterly, etc.). Trades are executed soon after open on the start date and continue on future dates based upon the schedule selected. If the market is closed on the scheduled recurring investment date (e.g.: holiday, weekend) then the recurring investment will be scheduled for the next open market date. If the schedule of monthly, quarterly, or yearly is selected and the recurring investment date does not exist for the month (e.g.: February 29th) then the last date of the month will be used. Please note, there is no guarantee that modifying the recurring investment on the scheduled day of investment will be reflected in your trading activity for that day.

5. What is the minimum amount required to invest when setting up a recurring investment?

The minimum investment amount for a recurring investment is 10 for all currencies except SEK which has a minimum of 100. The minimum investment amount will be displayed to clients in Client Portal if the amount they enter is less than the required minimum.

6. At what price does reinvestment take place?

As shares are purchased in the open market, the price cannot be determined until the total number of shares for all program participants have been purchased using combined funds. Each aggregate order will result in one or more market orders. In the event that the purchase is executed in multiple smaller trades at varying prices, participants will receive the weighted-average price of such shares (i.e., each participant receives the same price).

Recurring investments are filled through Volume-Weighted Average Price (VWAP) orders submitted on a best-effort basis at market open on each scheduled purchase date. The time in force suspends the same day at the close of the market. All customers with recurring investments in the same security on the same date receive the same average price on their investment. If markets are closed on a scheduled recurring investment date, due to a weekend or holiday, recurring investment orders will be placed the next trading day. If there is a partial fill, clients will receive shares valued at less than the requested amount and the next scheduled purchase date will be increased by the instructed frequency. If no fill occurs (IBKR is unable to purchase shares on that trading day) the client experience will be the same as if the markets are closed: recurring investment orders will be placed the next trading day without increasing the next scheduled purchase date.

7. Is the recurring investment program subject to a commission charge?

Yes, Standard Commissions as listed on the IBKR website are applied for the purchase. Commissions are charged based on the Currency and the Region the security is traded on. Please note that the minimum commission charge is the lesser of the stated minimums (USD 1 for the Fixed structure) or 1% of the trade value.

8. What happens if my account is subject to a margin deficiency when the recurring investment occurs?

If your account is in a margin deficit and cannot initiate new positions, the recurring investment will not occur, even if you have the feature enabled. A Deposit Hold can cause a recurring investment to be rejected. The trade will only occur if free cash is available. Clients that are borrowing on margin cannot use the recurring investment feature until they have free cash. Please note that recurring investment orders are credit-checked at the time of entry. Should an account go into margin deficiency at any time after that, including as a result of the end-of-day SMA check and the end-of-day Soft Edge Margin, the account will become subject to automated liquidation.

9. What happens if my account does not have enough funds at the time of the recurring investment?

The system will check the account 3 business days prior to the next occurrence of the recurring investment and if the account is lacking funds then a notification will be sent to the client. If on the occurrence date the account still lacks the funds, the occurrence date will be incremented by the frequency (e.g.: if monthly, update to next month). If on the next occurrence date the account again lacks funds then the instruction will be canceled.

10. Will I receive whole shares or fractional shares?

When using the Recurring Investment program you will receive fractional shares equivalent to the cash amount specified.

11. What are the tax considerations associated with recurring investment?

The purchase of a shares via recurring investment is similar to that of any other share purchase for purposes of tax reporting.

12. Where can I see the recurring investments I have set up?

The "Recurring Investments" screen in Client Portal will display a grid with your current active recurring investment plans.

Please note that open recurring investment instructions are not visible on the Trader Workstation (TWS) or IBKR Mobile order screens. Submitting orders from these platforms will increase your exposure beyond that scheduled for your recurring investment. Your open recurring investment orders are visible in Client Portal from both the Portfolio and Trade > Orders & Trades menus.

13. What happens if I don't hold the currency the stock is denominated in?

If you don't hold the currency the stock is denominated in, IBKR will auto-convert currencies to complete the trade.

14. What happens if my recurring investment involves a security that is no longer available?

Your recurring investment will be cancelled. When a pending order involves a security that is the subject of a reverse split or merger, or a security that is delisted, the order will be cancelled.

15. How do I cancel a Recurring Investment order?

To "Cancel" an open Recurring Investment, login to the Client Portal and select the Trade menu option followed by Recurring Investments. Find the line with the security of the recurring investment you want to cancel and on the right side of the row click on the "X". Then in the next pop up, click on the button to "Confirm Cancel" of the recurring investment.

Becoming a Professional Investor in Hong Kong

A Professional Investor (“PI”) is a high-net-worth investor who is considered to have a depth of experience and market knowledge that makes them eligible for certain benefits.

As per the Securities and Futures Ordinance (“SFO”), a PI includes entities and individual investors holding over HK$40 million in assets or an HK$8 million portfolio value, respectively.

Why become a Professional Investor?

Professional Investors are considered as having sufficient capital, experience and a net worth that lets them engage in more advanced types of investment opportunities, including products such as FX Swaps, ChiNext, or virtual assets.

Generally, Professional Investors do not need to liquidate investment assets in the short term and can experience a loss of their investment without damaging their overall net worth.

Which products are available to Professional Investors?

We are constantly expanding the selection of investments available to clients and periodically adding new products and services that are only available to Professional Investors.

The following products are currently available:

|

Product/ Market |

Professional Investor eligibility |

|

ChiNext |

Institutional - Professional Investor only |

|

Star |

Institutional - Professional Investor only |

|

FX Swap |

Professional Investor |

|

Crypto related products |

Professional Investor |

|

Mutual Funds |

Professional Investor |

How do I qualify as a Professional Investor in Hong Kong?

To qualify as a Professional Investor, you must meet or exceed prescribed financial thresholds, which vary by client category:

|

Client Category |

Financial Threshold / Requirement |

|

Individual |

A High Net Worth Individual in possession of cash and/or securities or have a portfolio held by a custodian of not less than HK$8 million (or its foreign currency equivalent). |

|

Joint* |

A High Net Worth Individual, with either his or her spouse or children in a joint account, in possession of cash and/or securities or have a portfolio held by a custodian of not less than HK$8 million (or its foreign currency equivalent). |

|

Corporation/ Partnership |

A corporation or partnership in possession of cash and/or securities or have a portfolio held by a custodian of not less than HK$8 million (or its foreign currency equivalent) or total assets of not less than HK$40 million (or its foreign currency equivalent). |

|

Trust Corporations |

A trust corporation that has been entrusted under the trust(s) of which it acts as trustee with total assets of not less than HK$40 million (or its foreign currency equivalent). Please note that all trustees, if more than one, must qualify as Professional Investors in order for the trust to qualify. |

* If you are a joint account holder, you must represent and warrant to Interactive Brokers Hong Kong (IBHK) that you and the other account holder are married or parent/ child and that there is no written agreement between you and the other account holder which governs the sharing of your joint portfolio. If you and the other account holder are not married or parent/ child, or if an agreement exists which governs the sharing of your joint portfolio, you must immediately notify IBHK.

What are the risks of becoming a Professional Investor?

Professional Investors are not afforded some of the protections given to general retail investors. In particular, IBHK is not required to fulfill certain requirements under the Code of Conduct and other Hong Kong regulations when providing services to Professional Investors. These include, but aren’t limited to, rules restricting or prohibiting the issuance of advertisements, the making of unsolicited calls and the communication of an offer in relation to securities.

IBHK recommends that prospective Professional Investors obtain independent professional advice, if deemed necessary, in relation to the consequences of being treated as a professional investor (including those set forth in the SFO and the Code of Conduct).

How can I opt out of being classified as Professional Investors?

Professional Investors have the flexibility to withdraw their consent at any point in time by changing their PI classification to “Non Professional Investor” via the Account Settings in Portal Once changed, PI-related trading permissions will be immediately removed and existing open positions will be set to “Closing- Only”. You may continue to hold or close existing position of these exclusive products but cannot expand or open new positions.

You may also cease to be classified as Professional Investor if you take no action to validate your eligibility during IBHK’s annual Professional Investor review. A notification email will be sent to you if your classification is not aligned to the PI financial threshold.

Professional Investor status is subject to IBHK’s validation of your assets. Investing in financial products and services is subject to IBHK’s eligibility and suitability criteria.

Hogyan tudom kiválasztani a legmegfelelőbb előfizetési szolgáltatást egy adott értékpapírra vonatkozóan?

Az IBKR ügyfelei használhatják a „Piaci adat asszisztens” eszközt, amely segítséget nyújthat a kereskedni kívánt értékpapírra (részvény, opció vagy warrant) vonatkozóan elérhető előfizetési szolgáltatások kiválasztásában. A keresés kilistázza az összes olyan tőzsdét, amelyen elérhető az adott termék, továbbá megjeleníti az előfizetési ajánlatot és a havi díjat a professzionális és a nem professzionális ügyfelek számára egyaránt, valamint az egyes előfizetésekhez kapcsolódó piaci eltérések mélységét.

A Piaci adat asszisztens elérésének lépései:

- Jelentkezzen be az Ügyfélportálra

- Kattintson a Súgó menüre (kérdőjel ikon a jobb felső sarokban), majd az Ügyféltámogató központra

- Görgessen lefelé, és kattintson a Piaci adat asszisztens lehetőségre

- Adja meg a tőzsdekódot vagy az ISIN-t és a tőzsdét

- Az opcionális szűrőknél válassza ki a megfelelőket: Professzionális / Nem professzionális előfizetői státusz, Deviza és Eszköz

- Kattintson a Keresés gombra

- Tekintse át az elérhető lehetőségeket, és válassza ki az Ön igényeinek legmegfelelőbb előfizetést.

További információkért látogasson el az IBKR weboldalán a piaci adatokról szóló oldalra.

Számlafeltöltés banki utalással

A banki utalás útján történő számlafeltöltéshez először be kell nyújtania egy számlafeltöltési értesítőt az Ügyfélportálon keresztül. Jelentkezzen be az Ügyfélportálra, és a menüben válassza az Utalások, be- és kifizetések > Utalás lehetőséget. A tranzakciók közül válassza a „Számlafeltöltés” lehetőséget, majd a befizetési módok közül a „Banki átutalás” lehetőséget.

Ezt követően adja meg az utalást indító bank adatait: a befizetés összege, pénznem, küldő intézmény. Az adatok megadását követően megjelenik egy letölthető nyomtatvány, amely tartalmazza az utalás részleteit (pl. bankazonosító kód (ABA), Swift BIC kód, bankszámlaszám), és amelyet továbbíthat a bankjának az átutalási megbízás elindításához.

Felhívjuk a figyelmét, hogy a számlafeltöltési értesítő kitöltése feltétlenül szükséges, mivel az Ön bankja számára az utaláshoz szükséges adatok az utalás pénznemétől függően eltérhetnek. Továbbá, a számlafeltöltési értesítő megléte biztosítja, hogy a beérkezést követően azonnal számlájára tudjuk irányítani az átutalt összeget.

Amennyiben további kérdése merül fel, vegye fel a kapcsolatot Ügyfélszolgálati központjaink egyikével. Az elérhetőségekről és a nyitvatartási időről az alábbi weboldalon tájékozódhat: http://individuals.interactivebrokers.com/en/index.php?f=1560

Changes to the Interactive Brokers Canada Inc. Client Agreement

Overview:

To address changes in our business, technology, services, markets, and other factors, Interactive Brokers Canada Inc. has revised the terms of our standard client agreement (Form 3206) ("Amended IB CAN Client Agreement").

For IB CAN accounts opened prior to June 9, 2021, the Amended IB CAN Agreement will be effective as of June 25, 2021. Continuing to maintain an IBKR account after June 25, 2021 shall constitute acceptance of the Amended IB CAN Client Agreement.*

The full text of the Amended IB CAN Client Agreement can be reviewed here:

https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2....

Sections or subsections (indicated in parentheses) of the Amended IB CAN Client Agreement that are new include, but are not limited to:

• Notice Requirements and Amendment of Terms (3)

• Special Risks of Algorithmic Orders (5 B)

• Payment for Orders and Rebates (6)

• Order Execution (8 C on pre-trade filters)

• Designation of Trusted Contact Person (12)

• U.S. Residents (14)

• Margin (15 B iii, iv and v)

• Closing Rights Positions Prior to Expiration (17)

• Mutual Funds (18)

• Worthless and Non-Transferable Securities (19)

• Position Limits (20)

• Unclaimed Property (29)

• Commissions and Fees, Interest Charges, Funds (33 C, D and E)

• Exposure Fees (34 B)

• Risks Regarding Political and Governmental Actions (36)

• Fractional shares (37 B)

• Indemnification (41)

• Fast and Volatile Markets (43)

• Physically Deliverable Futures (Schedule A / referenced in 32) *

Sections or subsections of the Amended Client Agreement that are not entirely new but have been substantively amended include, but are not limited to:

• Client Agreement (1)

• No Advice Regarding Investment, Tax, Trading or Account Type (2)

• Responsibility for Client Orders/Trades (4)

• Order Routing (5 A)

• Order Execution (8 A and B)

• Confirmations and Reporting Errors (9)

• Proprietary Trading – Display of Customer Orders (10)

• Client Qualification (11)

• Margin (15 B i and ii)

• Liquidation of Positions and Offsetting Transactions (16 all subsections)

• Universal Accounts (22)

• Short Sales (23)

• IBKR's Right to Loan/Pledge Assets (24)

• Security Interest (25)

• Event of Default (27)

• Suspicious Activity (28)

• Multi-Currency Function in IBKR Accounts (30 all subsections)

• Commodity Options and Futures Not Settled in Cash (32 all subsections)

• Commissions and Fees, Interest Charges, Funds (33 A and B)

• Account Deficits (34 A)

• Limitation of Liability (40 A)

• Client Must Maintain Alternative Trading Arrangements (42)

• Equity Options (57)

• Futures and Futures Options (58)

*Client's indication of an intent to make or take delivery on any Covered Contract as defined in Schedule A of the Amended Client Agreement shall constitute acceptance of the Amended Client Agreement as of the date of Client's indication of such intent, even if prior to June 25, 2021.

Changes to the Interactive Brokers LLC Client Agreement (Form 3203)

To address changes in our business, technology, services, markets, and other factors, Interactive Brokers LLC has revised the terms of our standard client agreement (Form 3203) ("Amended IB LLC Client Agreement").

For IB LLC accounts opened prior to April 16, 2021, the Amended IB LLC Agreement will be effective as of June 11, 2021. Continuing to maintain an IBKR account after June 11, 2021 shall constitute acceptance of the Amended IB LLC Client Agreement.*

The full text of the Amended IB LLC Client Agreement can be reviewed here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2....

Sections or subsections (indicated in parentheses) of the Amended IB LLC Client Agreement that are new include, but are not limited to:

- Notice Requirements and Amendment of Terms (3)

- Special Risks of Algorithmic Orders (5 B)

- Payment for Orders and Rebates (6)

- Order Execution (8 C on pre-trade filters)

- Designation of Trusted Contact Person (12)

- Custodial Accounts (14)

- Margin (15 B iii, iv and v)

- Closing Rights Positions Prior to Expiration (17)

- Mutual Funds (18)

- Worthless and Non-Transferable Securities (19)

- Position Limits (20)

- Unclaimed Property (29)

- Commissions and Fees, Interest Charges, Funds (33 C, D and E)

- Exposure Fees (34 B)

- Risks Regarding Political and Governmental Actions (36)

- Fractional shares (37 B)

- Indemnification (41)

- Fast and Volatile Markets (43)

- Physically Deliverable Futures (Schedule A / referenced in 32)*

Sections or subsections of the Amended Client Agreement that are not entirely new but have been substantively amended include, but are not limited to:

- Client Agreement (1)

- No Advice Regarding Investment, Tax, Trading or Account Type (2)

- Responsibility for Client Orders/Trades (4)

- Order Routing (5 A)

- Order Execution (8 A and B)

- Confirmations and Reporting Errors (9)

- Proprietary Trading – Display of Customer Orders (10)

- Client Qualification (11)

- Margin (15 B i and ii)

- Liquidation of Positions and Offsetting Transactions (16 all subsections)

- Universal Accounts (22)

- Short Sales (23)

- IBKR’s Right to Loan/Pledge Assets (24)

- Security Interest (25)

- Event of Default (27)

- Suspicious Activity (28)

- Multi-Currency Function in IBKR Accounts (30 all subsections)

- Commodity Options and Futures Not Settled in Cash (32 all subsections)

- Commissions and Fees, Interest Charges, Funds (33 A and B)

- Account Deficits (34 A)

- Limitation of Liability (40 A)

- Client Must Maintain Alternative Trading Arrangements (42)

*Client’s indication of an intent to make or take delivery on any Covered Contract as defined in Schedule A of the Amended Client Agreement shall constitute acceptance of the Amended Client Agreement as of the date of Client's indication of such intent, even if prior to June 11, 2021.

IBKR Notes FAQs

What are IBKR Notes?

IBKR notes are short term debt securities issued periodically by IBG LLC. Interactive Brokers LLC (IB), a broker-dealer affiliate of IBG LLC is the sole placement agent for the Notes. The U.S. dollar denominated Notes are issued at face value in $1,000 increments and the minimum subscription is $10,000. The Notes mature no later than the 30th day following issuance but may be redeemed sooner. The Notes pay a fixed rate of interest, which is set by adding a spread to the effective Federal Funds rate as reported by the New York Federal Reserve Bank on the morning of the date the Notes are sold to the purchaser. The minimum Rate is 0.50% per annum, and all interest is due and payable upon the earlier of the date of redemption or maturity of the Notes.

Who is eligible to invest in IBKR Notes?

Clients who are Accredited Investors are eligible to subscribe to IBKR Notes. If you are interested in further information about this private placement, you may confirm your Accredited Investor status and access the restricted IBKR Notes Program section of the Client Portal, which contains the confidential Offering Memorandum, Subscription Agreement and other information about the IBKR Notes Program.

Only US persons will be able to participate at this time.

Additional Information

Where can I sign up for IBKR Notes?

Qualified clients can use the button above or follow the below procedure to request to participate in the IBKR Notes program:

- Log in to Client Portal

- Select Settings followed by Account Settings

- In the Configuration section, next to Invest in IBKR Notes, you can see your account’s enrollment status in the program.

- If you are not enrolled, you can sign up by clicking the Configure (gear) icon next to Invest in IBKR Notes.

- You must read the agreement, sign your name, and click Submit to enroll.

How are the rates determined for IBKR Notes?

The issuer sets the interest rate for each Notes issuance at its discretion. The minimum interest rate for a Notes issuance is 0.50%. When there is a new Notes issuance, IBG LLC announces a Spread rate at least two days in advance. The Interest Rate on the Note is the Spread Rate plus the Benchmark Rate, which is the Federal Funds Rate on the morning of the new issuance.

Can I choose which IBKR Notes to invest in?

Yes. So long as you are enrolled in the IBKR Notes Program and have indicated via the Client Portal your intention to participate in future Notes Program issuances, you have a standing order to automatically purchase Notes from the Issuer, if and when offered by the Issuer, with free credit balances in your IBKR account (the “Free Cash Balance” is generally defined as cash in your IBKR account in excess of margin requirements and short stock value). IBKR provides controls to allow you to place parameters on your standing order, including, a maximum amount of Notes to purchase (in dollars) and a minimum Free Cash Balance to leave in your account after purchasing the Notes.

What are the minimum and maximum investment sizes for IBKR Notes?

Investors must purchase a minimum of $10,000 in aggregate principal amount of Notes and may not purchase more than $25,000,000 in aggregate principal amount. Notes are issued only in book-entry form, in denominations of $1,000 and integral multiples of $1,000.

Can IBKR Notes be redeemed early?

The Notes are redeemable prior to maturity only at the option of the Issuer. If the Issuer redeems the Notes prior to maturity, you will receive a notice of redemption. The principal and accrued and unpaid interest to and excluding the date of redemption will be credited to your IBKR account. Notes holders do not have the option to redeem their Notes holdings early.

Can I change my investment preferences in IBKR Notes?

Yes, you may change your Maximum Investment Amount and Minimum Uninvested Cash amount at any time by notifying us through Client Portal. You may also temporarily or permanently suspend your participation by setting the “Invest in All Upcoming Notes” preference to Off.

If you suspend your participation in the Notes Program, IBKR will not sell you Notes during any future issuances, but you will continue to hold existing Notes in your account until the earlier of their maturity or redemption. You may re-activate your participation in the Notes Program though the Client Portal at any time by setting the “Invest in All Upcoming Notes” preference to On.

Can I terminate my participation in the IBKR Notes program?

You may terminate your participation in the IBKR Notes Program at any time by notifying us through the Client Portal. IBKR may also terminate your participation in the Notes Program at any time and for any reason, including if you no longer meet the eligibility requirements or if you do not reaffirm that you meet such requirements upon our request. If your participation in the program is terminated, IBKR will not sell you Notes in any future issuance, but you will continue to hold existing Notes in your account until the earlier of their maturity or redemption. In addition, you will not be permitted to re-activate your participation in the Notes program without re-enrollment.

How are IBKR Notes reported on my Activity Statement?

IBKR Notes will be reported like a Bond on your Activity Statement. You will see Bond activity in various sections of your statement including the Performance Summary, Open Positions, Trades, and Financial Instrument Information sections. During the holding period, accrued interest is not reflected on the statement. Interest payments will be reflected upon redemption or maturity.

What happens if an IBKR Notes offering is oversubscribed?

In the event that an IBKR Notes offering is oversubscribed, IBKR will allocate notes to potential investors at its sole discretion. There is no guarantee that any potential investor, including you, will be allocated Notes.

Will the returns for IBKR Notes be included in Portfolio Analyst?

Yes, returns for IBKR Notes will be included in your Portfolio Analyst reports.

Are Notes Transferable?

No. Notes cannot be transferred between accounts at IBKR or to an external account. Notes must remain in the account they were initially allocated to until they mature (unless redeemed early by IBKR).

What happens if I close my account before my IBKR Note matures?

Clients must hold the Notes until they mature (unless redeemed early by IBKR). If you would like to close your account while you hold Notes, you may submit a close account request and request a transfer of your assets. However, Notes are non-transferrable, and the account will remain open until the Notes have matured and all assets have been transferred out of your account. During this period, account fees and charges may continue to apply. Please contact Customer Service should your account closure request be pending due to an existing Notes position before processing.

Can an advisor invest in IBKR Notes on behalf of their clients?

Yes. Advisors with trading discretion over their client accounts can invest in IBKR Notes on behalf of eligible clients through the IBKR CRM.

Are IBKR Notes included in the Net Liquidation Value calculation for fee-based advisor clients?

Yes. The value of the IBKR Notes in an IBKR account will be included in the calculation of Net Liquidation Value (NLV) fees. Interest will also be included in the calculation.

If I place a trade that uses the minimum required spare cash to invest in IBKR Notes, will my notes be liquidated?

The minimum spare cash requirement to invest in IBKR Notes is checked only when placing the initial Notes investment. It is not required to be maintained while the Note is outstanding.

Are IBKR Notes included in my Equity with Loan Value?

Yes, IBKR Notes are included in calculating your Equity with Loan Value.

If my account is in a margin deficit, will IBKR liquidate IBKR Notes?

If your account is in a margin deficit, IBKR will not liquidate your investment in IBKR Notes.

Additional Information

Where can I find the IBKR Notes Offering Memorandum?

The IBKR Notes Offering Memorandum is available at the time of enrollment as well as within the IBKR Notes page in the Client Portal. You may access this page by selecting Settings followed by Account Settings and Invest in IBKR Notes within the configuration section, and clicking the download Offering Memorandum link.

Are IBKR Notes marginable?

No. IBKR Notes are non-marginable and are ineligible for use as margin collateral. Additionally, the Initial Purchase will be capped to the USD cash balance in an account. An investment in IBKR Notes is not allowed if the purchase causes a USD debit balance.

Does the interest rate on an IBKR Note vary by amount invested?

No. All holders of a specific Note receive the same interest rate regardless of their individual investment amount.

How liquid are IBKR Notes?

The Notes are illiquid. No public market exists for the Notes. They are non-transferable and cannot be traded.

Are IBKR Notes “cash equivalents”?

No. IBKR Notes are illiquid short term debt investments. Cash equivalents generally are highly liquid instruments which are readily convertible into known amounts of cash.

How often are IBKR Notes issued?

Notes are issued at the discretion of the issuer.

What is the notice period for new IBKR Notes issuances?

There is a two-day notice period prior to newly issued Notes being allocated to your account. For example, if a new issuance notification is sent on Monday, the Note will post to your account on Wednesday evening. Interest begins accruing on settlement date (T+1), which would be Thursday.

How is interest calculated for IBKR Notes?

IBKR conforms to international standards for day-counting when calculating the interest paid on IBKR Notes.

IBKR utilizes the 30/360-day count convention, which means that interest income is determined based on a 360-day year. The actual number of calendar days each Note will be outstanding for is 30. But the number of days which accrue interest may be greater or lesser than 30 based on the specific time period Notes are issued, redeemed or mature.

Are Notes insured by SIPC, FDIC or any other entity?

No, the Notes are not insured by SIPC, FDIC or any other entity.

Any information provided about the IBKR Notes Program by Interactive Brokers LLC should not be construed as a solicitation or recommendation of any investment product. Each investor should review and determine independently whether or not IBKR Notes is suitable for them to invest in. In addition, all investors interested in IBKR Notes should review the details and associated risks found within the offering memorandum, accessible through the Client Portal.